In This Course You Will Learn :

-

How Mortgage Markets Work To Negotiate Your Best Loan Terms

-

How To Compare & HIRE The Right Loan Officer

-

Why What You "Qualify For" VS. "Can Afford To Pay" Matters

-

How To Save Time & Energy In The Application Process

Watch this video above.

20+ Years

HELPING HOMEOWNERS

3,000+

LOANS SECURED

Are you wanting to buy a home but nervous about applying for a mortgage?

We get it. You're dealing with...

Confusing Terminology.

The world of mortgages is filled with lenders that use confusing jargon and processes, which make it difficult to know exactly what you're getting into (or who to trust). We’re expected to know what everything means when applying for a mortgage and it can feel intimidating to ask questions.

Unique or Imperfect Finances

You're worried about resurfacing past issues like bad credit or debt, and the impact of life events to your finances. For example, planning a wedding, dealing with existing car payments or residual loans that make it easy to conclude it’s not the best time to move forward with buying a house.

Uncertainty About Being Able to Afford Payments

Even if you do qualify, you want to be sure you can pay it month to month confidently and with peace of mind.

You shouldn't feel confused about ANYTHING when it comes to borrowing a large amount of money that needs to be repaid.

You just need to understand & realize your own buying power, or how much you can afford monthly for a house payment, so you can have the upper hand when talking to mortgage lenders, brokers and banks.

That’s why we created Borrow Savvy

Borrow Savvy is a complete online course that simplifies the entire process of applying for and qualifying for a home loan - from understanding credit scores and how debt impacts your application to calculating your affordability and guaranteeing you have enough cash flow for your mortgage.

No matter what your financial situation is,

Borrow Savvy will guide you step by step in determining your affordability so you can buy your next home with confidence and peace of mind.

Truc B.

SAN JOSE, U.S.

My husband and I are now first time homeowners! All thanks to the help of Mike and his team :) During that time, we had a lot going on with our finances due to a wedding, existing car payments, and residual loans so we concluded it wasn't the best time to move forward with a mortgage. Mike and his team never made us feel as if we wasted their time but instead gave us solutions to increase our affordability as well as a budgeting worksheet to help us get on track.

Scott S.

Washington, U.S

I had the opportunity to get some one-on-one coaching from Mike while obtaining a mortgage for a home I recently purchased. Mike's advice gave me the confidence I needed to negotiate the interest rate on my loan. His tips took the stress out of the process and allowed me to negotiate a much better interest rate that will save me tens of thousands of dollars on the cost of my loan! Based on my experience working with Mike, I think his 'Borrow Savvy' course will be a terrific asset to anyone interested in obtaining a mortgage!

WHAT'S INCLUDED?

15+ Video Training Modules

Checklist of Lender Requirements

Budget Analysis & Affordability Spreadsheet

Qualifying Questions to Ask Lenders

Mortgage Lingo Glossary

Quick Payment Calculation Form

FULL COURSE CURRICULUM

15+ video training modules to guide you through every step of the process - before, during and after - in qualifying for a home loan.

MODULE 1: Quick Start & Course Summary

Est. Value: $375+

MODULE 2: De-Mystify The Home Loan Process

Est. Value: $180

MODULE 3: Budget - What Can I Afford?

Est. Value: $240

MODULE 4: Credit

Est. Value: $240

MODULE 5: Income

Est. Value: $240

MODULE 6: Down Payment / Assets

Est. Value: $280

MODULE 7: Debt - What Is The Impact

Est. Value: $240

MODULE 8: Putting It All Together

Est. Value: $360

MODULE 9: Behind The Curtain - Role Reversal

Est. Value: $240

MODULE 10: Pre-Approval

Est. Value: $180

MODULE 11: The Team

Est. Value: $240

MODULE 12: The Contract

Est. Value: $360

MODULE 13: What Can Go Wrong??

Est. Value: $360

MODULE 14: Financial Literacy 101

Est. Value: $240

MODULE 15: Conclusion & Guarantee

Est. Value: $180

Total Estimated Value: $3,739

Get Access Today For Just: $3,739 $1,869 $197

*** LIMITED TIME OFFER: Price goes up May 1st, 2024! ***

You don’t need to navigate through this complicated process alone.

Borrow Savvy will save you upwards of several thousands of dollars and YEARS of stress in trying to figure this out on your own.

Become Borrow Savvy & Enroll Now

Meet Your Instructor

Michael Aning

I know what it's like to start this journey of buying a home on your own and feeling lost or alone in this process. If you are uncertain, you are unprotected and you leave EVERYTHING exposed.

Unlike other mortgage lenders, we care about helping you identify what you can AFFORD to repay - not just what you can "qualify" for.

That's why for over 20 years, I've helped thousands of homeowners understand the full scope of their financial situation to avoid making costly mistakes or being taken advantage of by lenders.

It's my mission to empower you with this knowledge so that you know exactly what options are best and you can make better decisions for your you & family's future.

The Borrow Savvy program will give you everything you need to go through this process from a a position of advantage so you buy your next home with peace of mind.

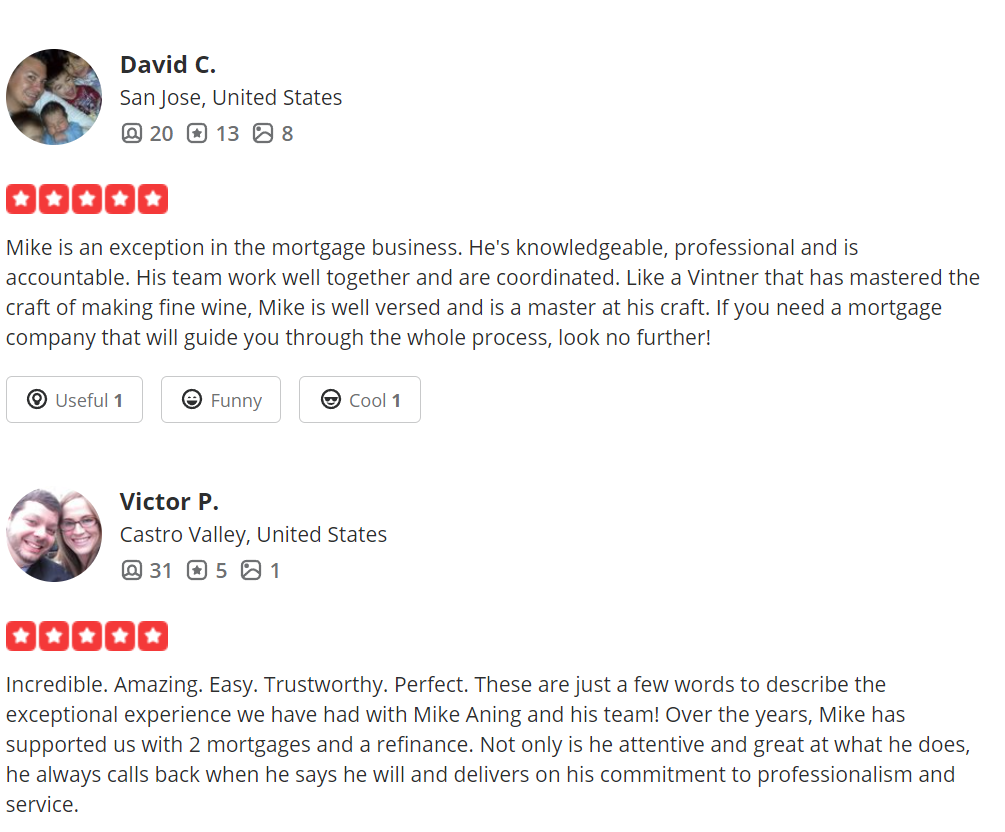

We care about helping you become Borrow Savvy, a lot.

AND IT SHOWS IN OUR WORK.

100% Money Back Guarantee

Enroll in Borrow Savvy with 0 risk.

When you enroll, you will get instant access to all the materials included in the first month of the program. If you are not completely satisfied with the course after this first month, I will happily refund 100% of your purchase upon request.

3 Steps Away from Qualifying for a Home Loan That You Can Confidently Pay Back

Buy the Course

Hit the button below to get instant access to the Borrow Savvy training and start watching the video lectures.

Determine Your Affordability

Do the work to understand your own buying power and go through our budget exercises to determine how much you can afford monthly for a house payment.

Apply for a Home Loan

The loan process will be completely de-mystified for you and you'll be able to apply for a home loan knowing that you can 100% afford to pay it back.